Think Rich, Act Rich, Be Rich!

Sounds simple enough! Ever listen to people talk about the rich? “Why don’t the wealthy pay for it?” or “The wealthy should pay more in taxes and give it to the poor!” are frequently heard in such conversations.

Do you realize that it’s the middle class that pays for the poor, especially the educated upper-income middle class! So, what do the wealthy know and do that is so much better than the poor or middle class? Read on and learn to “Think Rich!”

A Little About Taxes…

[list class=”cross”]- In 1874, England made income tax a permanent levy on its citizens.

- In 1913, the United States made the income tax permanent.

- Both of these countries initially levied the income tax against only the wealthy!

- In response, the Wealthy utilized the Corporate structure as a vehicle to limit their risk and tax liability. Think Rich and prosper!

How the Wealthy Play the Game!

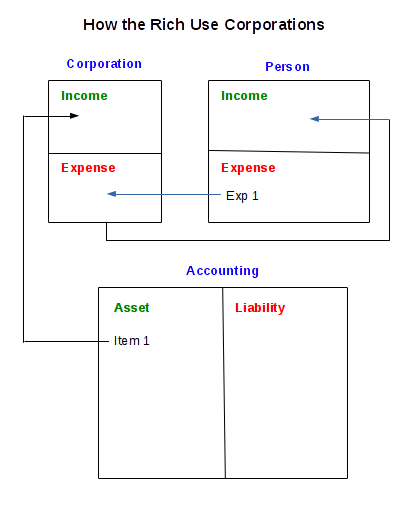

As a result of incorporating, assets (Income) move to the corporation instead of directly being paid to the Person. This not only protects the asset from personal liability, it also removes the asset from the person and any personal tax liability! Consequently, this knowledge is powerful and the first step in understanding the exclusive legal strategy of the Wealthy and their use of corporations! Think Rich!

Secondly, what was an expense to the Person moves to the corporation. And, here is another key component: corporations pay tax only on assets (income) left over after paying all their expenses! Think Rich!

So, after paying the expenses of the corporation, the corporation may pay a personal salary or wage, which would also be an expense to the corporation. The result of this lower amount passing to the person means less individual taxes to pay!

If the corporation pays all the expenses and pays the Person, then any money left in the corporation would be taxed at the corporate rate. Therefore, depending on the tax laws, this could be zero if handled properly.

Therefore, it is this knowledge that gives the wealthy a great advantage. And, knowing how to use a corporate structure to avoid taxes is perfectly legal. Evasion is unlawful for a taxpayer! The people who lose are the uninformed! So, from now on, Think Rich!

What’s Your Financial I.Q.?

There are four areas of expertise you need to know to Think Rich:

[list class=”cross”]- Accounting: the ability to read and understand financial statements.

- Investing: Making your money make money (passive income).

- Understanding Markets: Supply & Demand. Technical indicators & Fundamentals of the financial markets.

- The Law: Utilizing a corporate structure.

- Tax Advantages: a corporation can do things that an individual cannot!

- Privacy & Protection: from lawsuits.

| A Corporation |

A Person (Poor Soul) |

| Earns Money | Earns Money |

| Spends Money | Pays Taxes |

| Pays Taxes on what’s left | Spends what’s left |

Take note of the difference!

Think Rich not Poor!

How to Incorporate…

In addition to the knowledge of using a corporate structure to reduce taxes and protect assets, think rich and realize there are also advantages to incorporating in the most tax friendly state!

Did you know that in the United States, there are a hand full of states that do not tax corporate income or impose any other financial liability on corporate assets. Also, only one state in the country does not share financial information with the IRS – Nevada! Think Rich, Nevada!

However, in recent years the Nevada state government has increased filing fees and created a statewide business license, both of which are payable yearly. Even so, those items are deductible expenses and there are still many more advantages that make Nevada a perfect state to incorporate.

No matter in what state you live, think rich because you can incorporate in any state as long as you maintain a registered agent in the state where you incorporate. Also, registered Agents charge a yearly fee to represent a corporation to the state. These fees vary, but are reasonably low. Another deductible expense for the corporation! In addition, you can open the corporate bank account in the state where you incorporate – another great advantage! Think Rich and prosper!

To begin your wealth journey:

Think About Incorporating!

[signup id=”1340″]

Whatever you do, remember to first: Think Rich, Think Rich, Think Rich!